Future-proofing assets today for tomorrow’s climate extremes™

Leading Climate Risk Intelligence™ Trusted by Organizations Worldwide and Featured In

AI CSR Awards

AI Global Excellence Awards

AI Global Media

Bentley Ecosystem Catalog

Blently

Bloomberg

Chase

Climatebase

Climate Adaptation Forum

Climate & Capital Media

CNN

ConstructionWYRE

Corporatelivewire Global Award winner

Daily CADCAM

Digital Built World Summit

Environmental Business Council of New England

Earth Imaging Journal

Engineering-com

Environmentanalyst Global

Foundation for Climate Restoration

FT Financial Times

FuturePlace

F65

ikeGPS

MarketWatch

Mass ECAN

Merrill Edge

Morningstar

Seeking Alpha

Smart Energy International

Sustainability delivery solution

The Globe And Mail

TD Ameritrade

Trimble

Truman Center

Truman National Security Projecty

Wall Street Green Summit

Yahoo Finance

AI-Powered Climate Risk Intelligence

ClimaTwin’s leading Climate Risk Intelligence™ solution empowers

infrastructure owner-operators, engineers, consultants, investors, insurers, and other stakeholders

to make smarter, future-ready decisions.

Actionable Insights, Data, and Analytics

Broad Spectrum of

Acute & Chronic Weather Hazards

Proprietary climate models engineered from

best-in-class regional and global datasets, downscaled using AI and specialized methods

to reveal hyperlocal insights with industry-leading spatial and temporal resolution

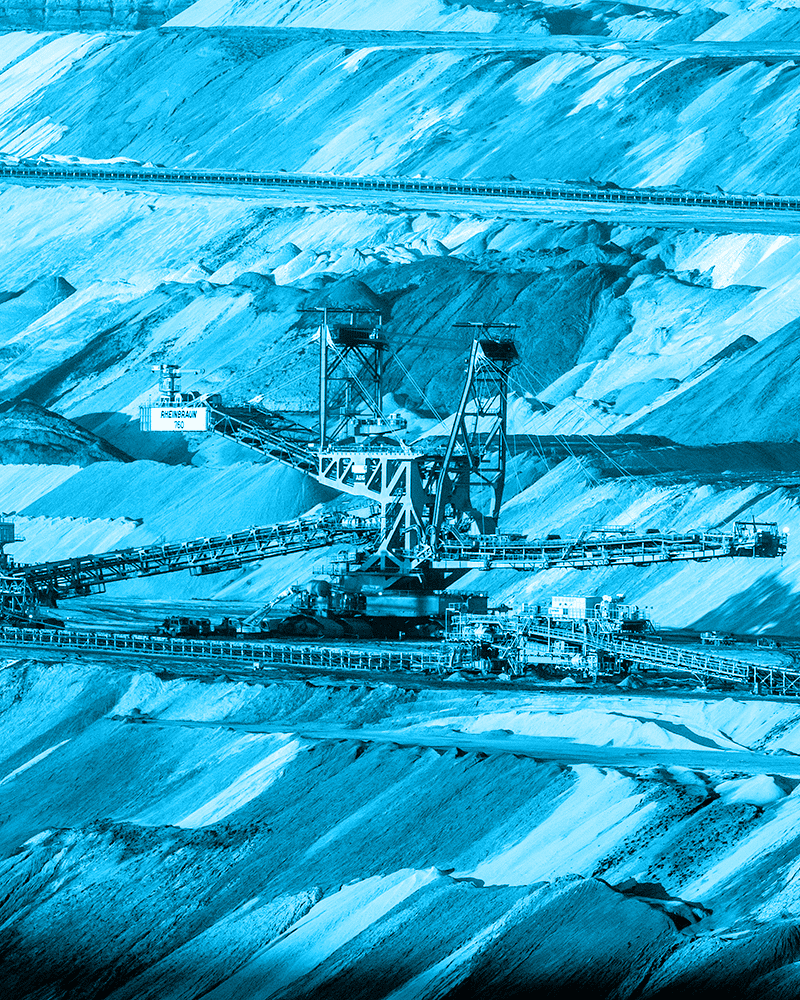

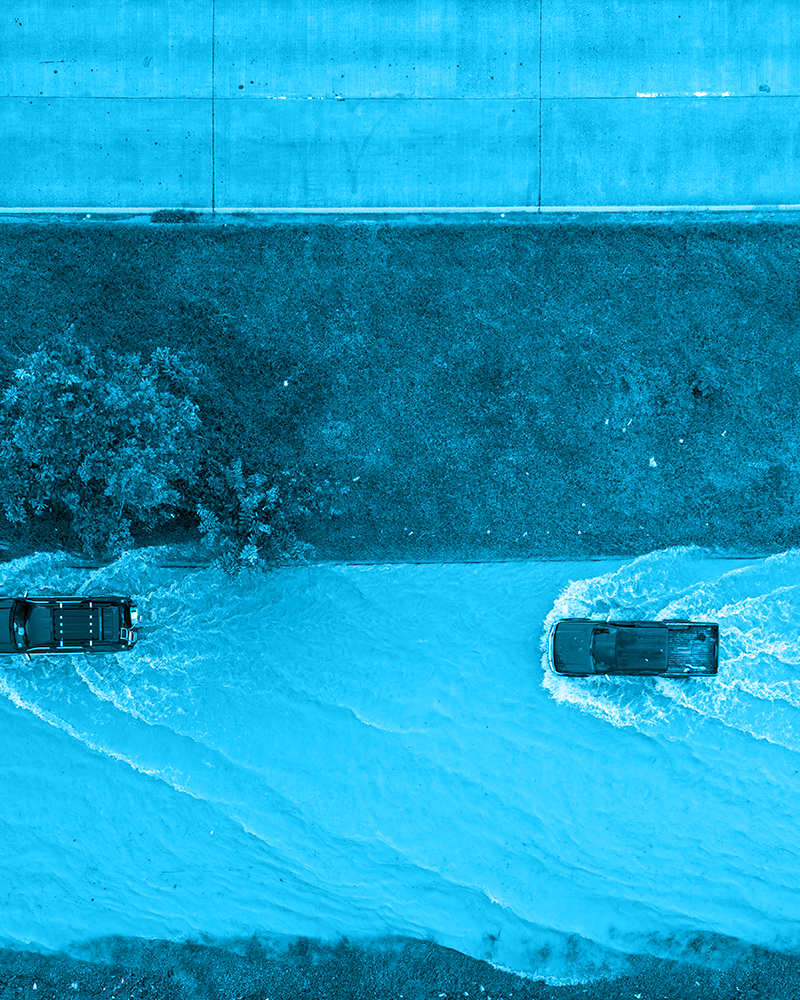

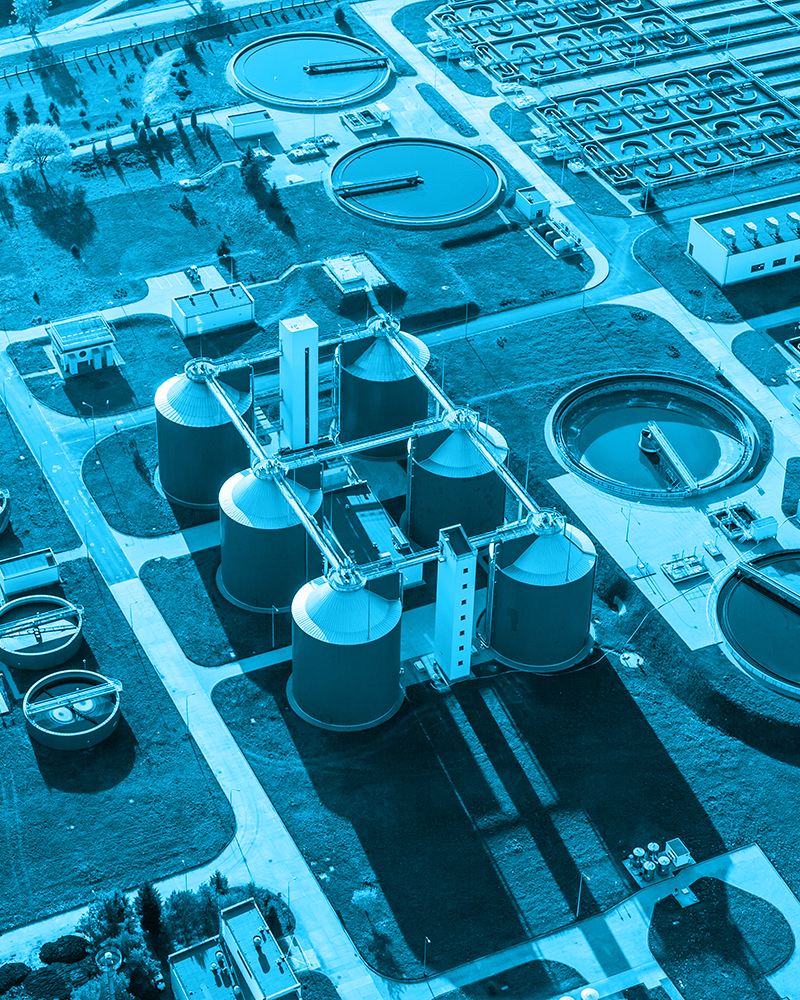

Select Industries Served

Supported Reporting Frameworks

ClimaTwin aligns with leading global and jurisdictional

sustainability disclosure standards—including ISSB, IFRS, CSRD, TCFD, and more—to ensure

your reporting meets the highest benchmarks for transparency, compliance,

and climate risk governance.

ISSB

IFRS S1 & S2

IFRS

International Financial Reporting Standards

TCFD

Task Force on Climate-related Financial Disclosures

CSRD

EU Corporate Sustainability Reporting Directive

ESRS

European Sustainability Reporting Standards

UK SDR

UK Sustainability Disclosure Requirements

CFRF

Climate Financial Risk Forum

CSDS

Canadian Sustainability Disclosure Standards

OSFI

Office of the Superintendent of Financial Institutions

California Climate Disclosure Laws

SB-261, SB-253, SB-219

GRI

Global Reporting Initiative

SASB

Sustainability Accounting Standards Board

TNFD

Taskforce on Nature-related Financial Disclosures

SBT

Science Based Targets

UN SDG

United Nations Sustainable Development Goals

Recent Articles

By our team of thought leaders, industry innovators, and PhDs

in engineering software, risk management, climate science,

geospatial analytics, econometric applications, and regulatory law

Blog

Read moreFaster claims, smarter underwriting, and stronger resilience, powered by Climate Risk Intelligence™.

Climate Risk Intelligence™ For Insurance Claims: Faster Response, Lower Losses, And Stronger Resilience

Faster claims, smarter underwriting, and stronger resilience, powered by Climate Risk Intelligence™. Part of a new industry series Insuring the Future™: Climate Risk Intelligence™ for Insurance...

News

Environmental Business Council Of New England, Climate Adaptation Forum Opens Steering Committee Nominations

Executive Summary The Climate Adaptation Forum, convened by the Environmental Business Council of New England (EBC) and the Sustainable Solutions Lab at the University of Massachusetts Boston, is...

Science

Earth Observation Satellites And The UNFCCC Belém Adaptation Indicators: Making Climate Adaptation Measurable

Executive Summary The Belém Adaptation Indicators are a UN-backed set of 59 metrics created to track progress toward the Global Goal on Adaptation under the Paris Agreement. However, turning these...

Standards

Climate-Related Financial Risk Management For U.S. Banks: A Standards-First Approach

Executive Summary U.S. bank leaders should treat climate-related financial risk as a safety-and-soundness topic, not a separate “climate program.” The practical requirement is to show that...

Ready To Get Started?

physical and financial impacts of future weather and climate extremes

on your infrastructure assets, capital programs, and investment portfolios.