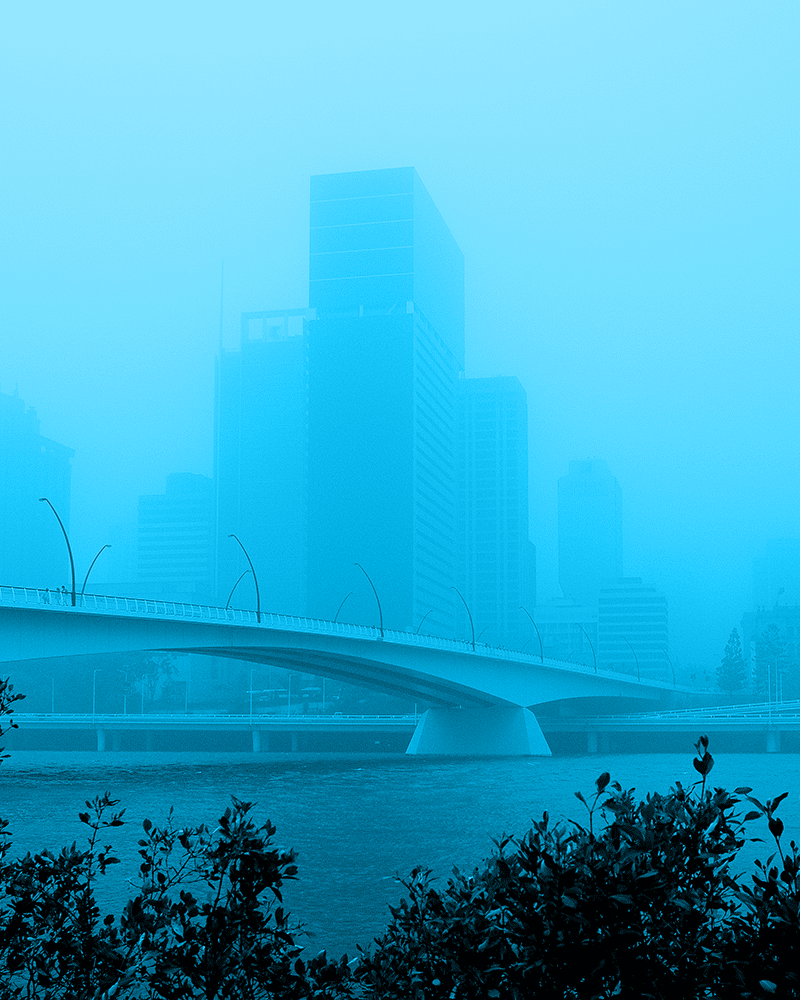

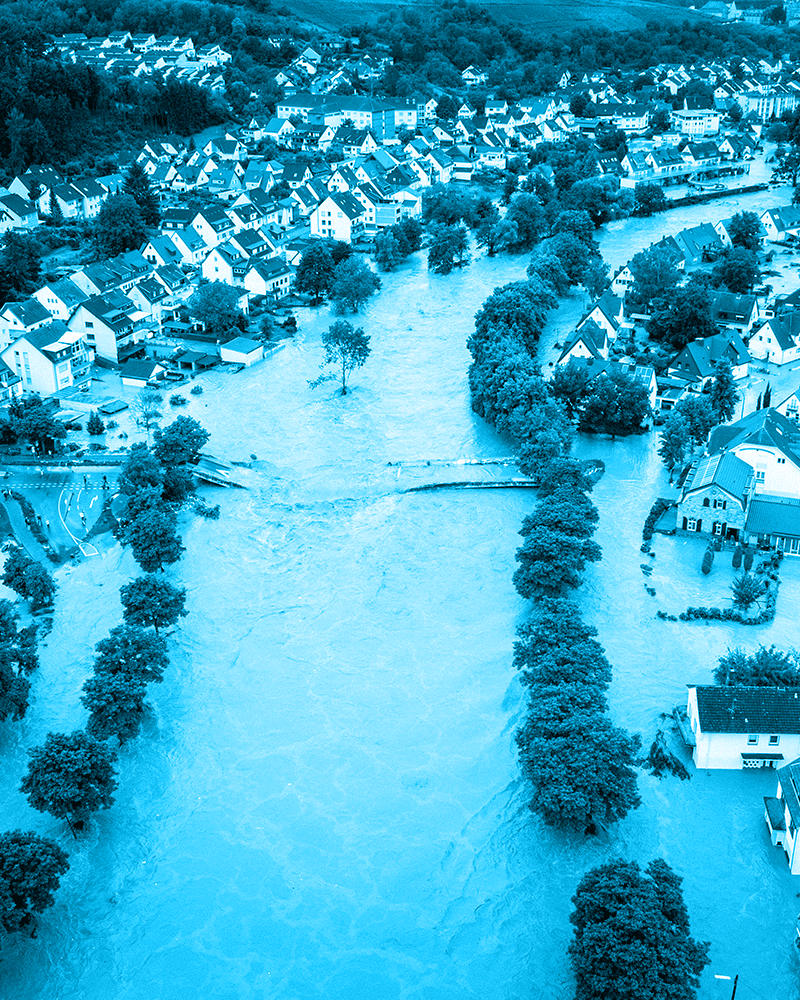

Future-proofing assets today for tomorrow’s climate extremes™

Leading Climate Risk Intelligence™ Trusted by Organizations Worldwide and Featured In

AI CSR Awards

AI Global Excellence Awards

AI Global Media

Bentley Ecosystem Catalog

Blently

Bloomberg

Boston Climate Week

Chase

Climatebase

ClimaTech

Climate Adaptation Forum

Climate & Capital Media

CNN

ConstructionWYRE

Corporatelivewire Global Award winner

Daily CADCAM

Digital Built World Summit

Environmental Business Council of New England

Eco-Business

Earth Imaging Journal

Engineering-com

Environmentanalyst Global

Foundation for Climate Restoration

FT Financial Times

FuturePlace

F65

ikeGPS

MarketWatch

Mass ECAN

Merrill Edge

Morningstar

Seeking Alpha

Smart Energy International

Sustainability delivery solution

The Globe And Mail

TD Ameritrade

Trimble

Truman Center

Truman National Security Projecty

Wall Street Green Summit

Yahoo Finance

AI-Powered Climate Risk Intelligence

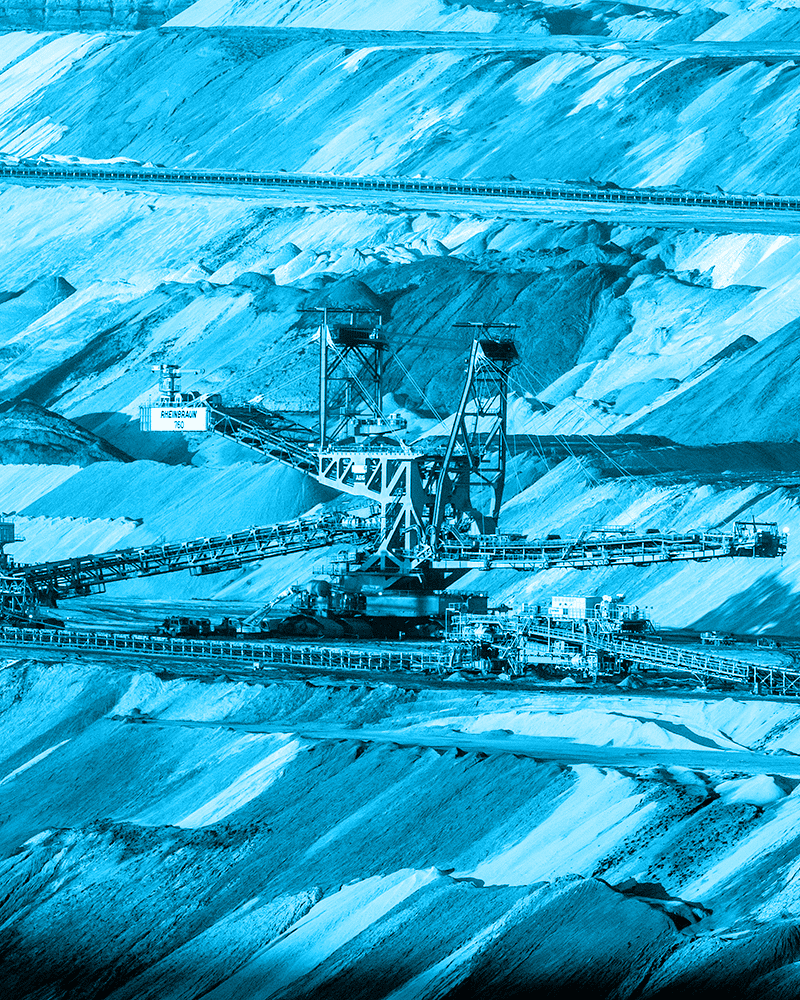

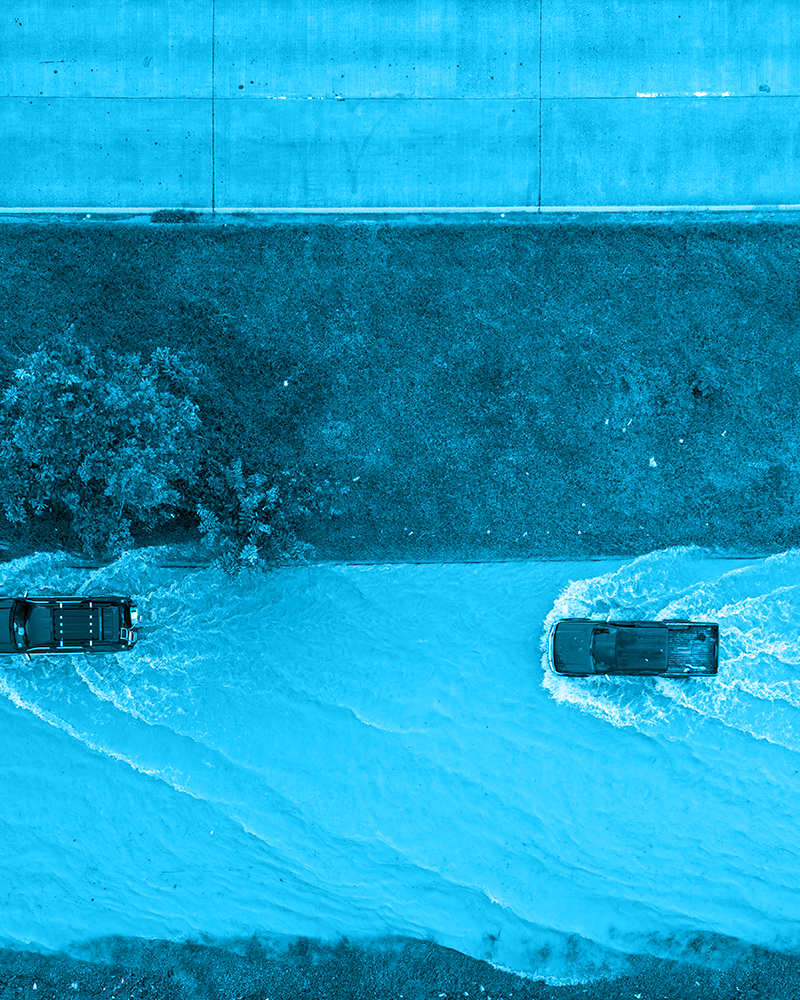

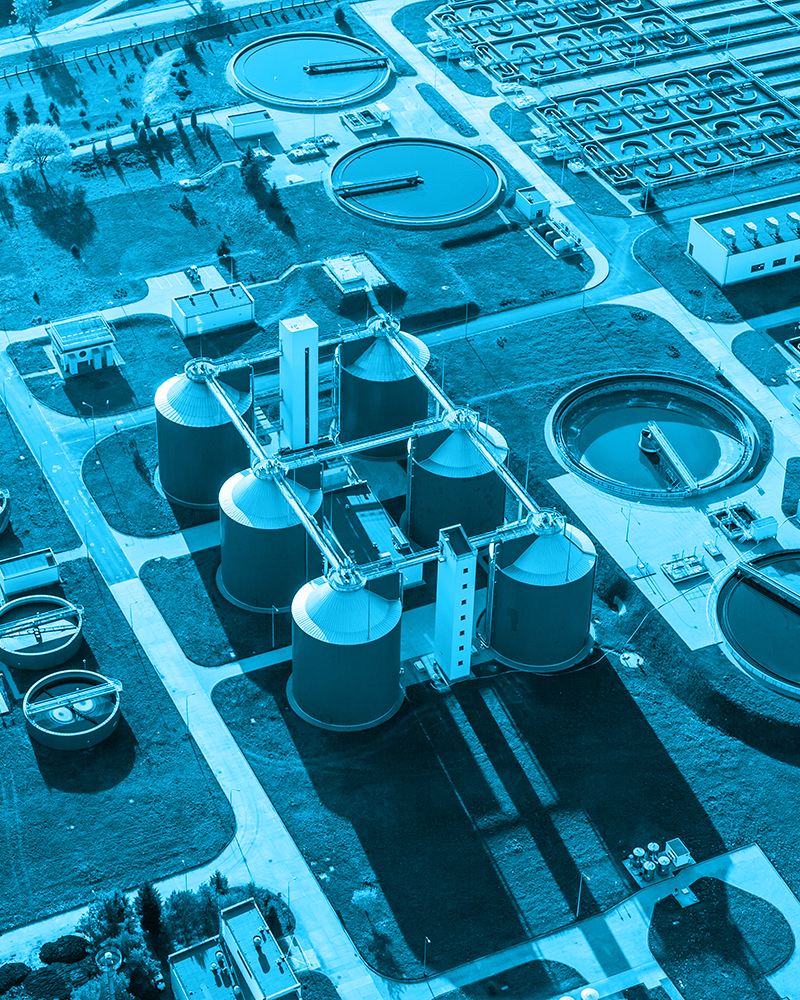

ClimaTwin’s leading Climate Risk Intelligence™ solution empowers

infrastructure owner-operators, engineers, consultants, investors, insurers, and other stakeholders

to make smarter, future-ready decisions.

Actionable Insights, Data, and Analytics

Broad Spectrum of

Acute & Chronic Weather Hazards

Proprietary climate models engineered from

best-in-class regional and global datasets, downscaled using AI and specialized methods

to reveal hyperlocal insights with industry-leading spatial and temporal resolution

Select Industries Served

Supported Reporting Frameworks

ClimaTwin aligns with leading global and jurisdictional

sustainability disclosure standards—including ISSB, IFRS, CSRD, TCFD, and more—to ensure

your reporting meets the highest benchmarks for transparency, compliance,

and climate risk governance.

ISSB

IFRS S1 & S2

IFRS

International Financial Reporting Standards

TCFD

Task Force on Climate-related Financial Disclosures

CSRD

EU Corporate Sustainability Reporting Directive

ESRS

European Sustainability Reporting Standards

UK SDR

UK Sustainability Disclosure Requirements

CFRF

Climate Financial Risk Forum

CSDS

Canadian Sustainability Disclosure Standards

OSFI

Office of the Superintendent of Financial Institutions

California Climate Disclosure Laws

SB-261, SB-253, SB-219

GRI

Global Reporting Initiative

SASB

Sustainability Accounting Standards Board

TNFD

Taskforce on Nature-related Financial Disclosures

SBT

Science Based Targets

UN SDG

United Nations Sustainable Development Goals

Recent Articles

By our team of thought leaders, industry innovators, and PhDs

in engineering software, risk management, climate science,

geospatial analytics, econometric applications, and regulatory law

Blog

Read moreCampus “system of systems” resilience reduces downtime, risk, and cost.

Campus Climate Resilience: Managing A “System Of Systems” When Failures Cascade

Campus “system of systems” resilience reduces downtime, risk, and cost. Part of a new industry series Educating the Future™: Climate Risk Intelligence™ for University Campuses University Campuses at...

News

From Climate Data To Public Action: Key Themes From The Climate Adaptation Forum

Event Overview The hybrid Climate Adaptation Forum, Climate Adaptation Communication – Decoding Data and Risk for All, took place on Friday, March 6, 2026. The forum centered on a practical...

Science

Key Takeaways From Nature Call For A Global Assessment Of Avoidable Climate-Change Risks

Executive Summary In a 25 February 2026 Nature Comment, Peter A. Stott and colleagues argue that climate governance still lacks an authoritative, internationally mandated assessment of avoidable...

Standards

10-Country Review: Why Adaptation Taxonomy Gaps Are Slowing Climate Finance In Asia

Executive Summary A February 23, 2026 report in Green Central Banking, drawing on new analysis from the Institute for Energy Economics and Financial Analysis (IEEFA), argues that Asia’s climate...

Ready To Get Started?

physical and financial impacts of future weather and climate extremes

on your infrastructure assets, capital programs, and investment portfolios.