The following post is part of a series entitled Mining the Future: Climate Risk Intelligence for the Metals and Minerals Industry:

Executive Summary: The metals and minerals industry faces two key climate-related threats: physical risks, such as extreme weather and long-term environmental changes that disrupt operations and infrastructure, and transition risks, arising from global moves toward a low-carbon economy, including policy shifts, market changes, and increasing stakeholder expectations. These immediate and strategic risks require proactive planning and climate risk intelligence to ensure resilience, regulatory compliance, and long-term business viability.

In the context of climate risk intelligence, two primary categories of threats are increasingly shaping the future of the metals and minerals industry: physical risks and transition risks. Both are fundamentally linked to climate change but manifest differently, affecting operations, asset valuations, regulatory obligations, and long-term strategic planning.

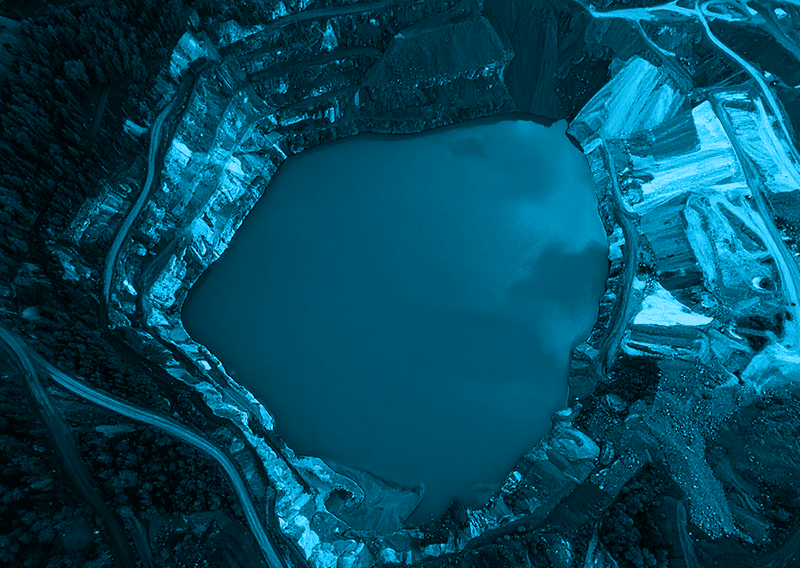

Physical risks refer to climate change’s direct, tangible impacts on mining operations and infrastructure. These include both acute and chronic events. Acute risks are extreme weather events—floods, cyclones, wildfires, and intense storms—that can disrupt mining activities, damage equipment, and endanger worker safety. For instance, flooding of open-pit mines can halt production for weeks and lead to long-term drainage and water contamination issues. Chronic risks such as rising temperatures, droughts, and sea level rise are slower-moving. These risks can degrade productivity, compromise water availability, and affect energy reliability, especially for remote sites that depend on hydro or diesel power. These events’ increasing volatility and unpredictability challenge historical norms and require rethinking engineering, logistics, and emergency preparedness strategies.

Transition risks, on the other hand, are linked to the global transition to a low-carbon economy. These risks arise from policy changes, market shifts, technological developments, and societal expectations to combat climate change. Examples include the implementation of carbon pricing, establishing new environmental regulations, or changing demand influenced by clean energy technologies. For instance, coal and high-carbon iron ore producers may encounter reduced market access or falling prices. Meanwhile, companies extracting “transition minerals” like lithium, nickel, and cobalt may experience increasing demand but also face intensified scrutiny regarding environmental and social practices.

Additionally, reputational and legal risks are closely associated with transition pressures. Investors, regulators, and civil society now expect mining companies to disclose their climate risks transparently and demonstrate credible pathways toward emissions reduction and resilience. Failing to do so can lead to exclusion from ESG investment portfolios, difficulties securing financing, or even legal action.

Understanding the distinction—and interplay—between physical and transition risks is essential for mining companies aiming to future-proof their operations. While physical risks threaten immediate continuity and safety, transition risks present long-term strategic and financial challenges. These risks create a comprehensive framework for assessing climate-related exposure and shaping an effective, resilient response.

Ready to get started? To learn more about how ClimaTwin can help you assess the physical and financial impacts of future weather and climate extremes on your infrastructure assets and investment portfolios, please visit www.climatwin.com today.

© 2025 ClimaTwin Corp. ClimaTwin® is a registered trademark of ClimaTwin Corp. The ClimaTwin logos, ClimaTwin Solutions™, and Future-proofing assets today for tomorrow’s climate extremes™ are trademarks of ClimaTwin Corp. All rights reserved, including rights for text and data mining and training of artificial technologies or similar technologies.

###