The following post is part of a series entitled Mining the Future: Climate Risk Intelligence for the Metals and Minerals Industry:

The metals and minerals industry holds a distinct position in the global economy and faces an equally unique level of exposure to climate risk. Unlike many sectors that can adapt through remote work or supply chain adjustments, mining operations are tied to fixed geographic locations, often found in remote, climatically vulnerable areas. This geographic immobility makes mining sites highly sensitive to physical climate hazards and transition-related disruptions, placing them on the front lines of climate-related risk.

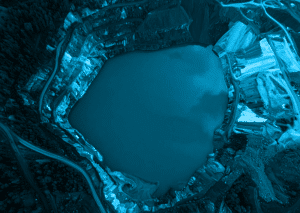

Mining infrastructure—such as open pits, underground tunnels, tailings dams, access roads, and processing facilities—is often found in arid deserts, mountainous regions, or tropical areas, where the impacts of extreme heat, drought, heavy rainfall, and flooding are already intensifying. For instance, in Australia and Chile, prolonged droughts have limited water access for copper and lithium operations, while in Indonesia and West Africa, increasingly severe storms have led to road washouts, equipment losses, and safety risks. Many mines also depend on single access routes or isolated energy sources, making them particularly susceptible to cascading failures when natural hazards occur.

Furthermore, mining is a water- and energy-intensive industry. As climate change impacts the availability and cost of these inputs, operational costs may rise due to scarcity and decarbonization mandates, and reliability could diminish. For instance, disruptions at thermal power plants caused by heatwaves or low river levels can compromise the electricity supply to mining sites. Similarly, stricter water withdrawal permits or competition with local communities during droughts can limit operating flexibility.

The sector also faces regulatory and market pressures that influence climate exposure. Transition minerals such as lithium, cobalt, rare earth elements, and nickel are vital to the clean energy transition, placing mining companies at the core of geopolitical and economic strategies for decarbonization. However, this attention brings increased environmental, social, and governance (ESG) scrutiny, particularly regarding land use, emissions intensity, and community relations. Companies not meeting the evolving expectations for responsible production risk losing their social license or facing divestment.

Meanwhile, traditional carbon-intensive extractives—such as coal and bauxite—are increasingly viewed as liabilities in low-carbon investment portfolios. This can result in asset stranding, higher capital costs, and sudden shifts in demand.

In summary, the mining sector’s distinct climate exposure arises from its fixed physical footprint, resource dependencies, environmental impact, and its crucial role in the energy transition. Tackling this exposure necessitates a customized, data-driven approach to climate risk management that incorporates engineering resilience, transparent reporting, and long-term scenario planning. Acknowledging the uniqueness of this exposure is the first step toward creating a sustainable and competitive future for the industry.

Ready to get started? To learn more about how ClimaTwin can help you assess the physical and financial impacts of future weather and climate extremes on your infrastructure assets and investment portfolios, please visit www.climatwin.com today.

© 2025 ClimaTwin Corp. ClimaTwin® is a registered trademark of ClimaTwin Corp. The ClimaTwin logos, ClimaTwin Solutions™, and Future-proofing assets today for tomorrow’s climate extremes™ are trademarks of ClimaTwin Corp. All rights reserved, including rights for text and data mining and training of artificial technologies or similar technologies.

###