The following post is part of a series entitled Mining the Future: Climate Risk Intelligence for the Metals and Minerals Industry:

For the metals and minerals industry, climate risk intelligence is no longer just a matter of regulatory compliance or corporate social responsibility; it has become a fundamental business imperative. As climate-related disruptions intensify and global efforts to transition to a low-carbon economy accelerate, mining companies face increasing financial, operational, and reputational pressures. Understanding and proactively managing climate risk is essential for maintaining business continuity, accessing capital, protecting assets, and sustaining long-term competitiveness.

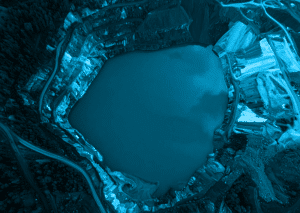

Mining operations are particularly susceptible to both physical and transition risks. Severe weather events—like floods, droughts, and extreme heat—can disrupt production, damage infrastructure, and jeopardize worker safety. Transition-related developments such as carbon pricing, decarbonization policies, and ESG investor mandates are altering market dynamics and cost structures. Companies that do not anticipate and adapt to these forces may encounter stranded assets, loss of market access, and increased insurance and capital costs.

Moreover, major institutional investors, insurers, and lenders increasingly embed climate risk metrics into their decision-making. Entities like the Task Force on Climate-related Financial Disclosures (TCFD) have established climate scenario analysis and risk disclosure as a standard expectation for large corporations, including those in the extractives sector. As a result, mining firms that lack credible climate strategies risk being sidelined in financial markets or facing unfavorable lending terms.

Climate risk intelligence also presents a strategic opportunity. By identifying and incorporating climate vulnerabilities early in planning, mining companies can enhance resilience, reduce costs, and strengthen stakeholder trust. For example, assessing water scarcity projections can inform site selection and technology investments, while modeling transition risk scenarios can help future-proof business portfolios. In the race to supply transition-critical minerals like lithium, nickel, and rare earth elements, companies with strong climate risk frameworks are better positioned to win contracts, form partnerships, and meet buyer expectations.

Finally, a growing societal demand for transparency and responsible resource development exists. Communities, regulators, and civil society expect mining companies to operate sustainably and disclose their climate impact and response plans. Climate risk intelligence allows firms to convey these commitments credibly and manage risks that might otherwise provoke opposition or legal challenges.

In summary, climate risk intelligence is no longer optional but essential. It empowers mining companies to guard against downside risks and position themselves as leaders in a rapidly evolving global landscape. Those who invest in robust climate strategies today will be better equipped to thrive in tomorrow’s mining sector.

Ready to get started? To learn more about how ClimaTwin can help you assess the physical and financial impacts of future weather and climate extremes on your infrastructure assets and investment portfolios, please visit www.climatwin.com today.

© 2025 ClimaTwin Corp. ClimaTwin® is a registered trademark of ClimaTwin Corp. The ClimaTwin logos, ClimaTwin Solutions™, and Future-proofing assets today for tomorrow’s climate extremes™ are trademarks of ClimaTwin Corp. All rights reserved, including rights for text and data mining and training of artificial technologies or similar technologies.

###