Frameworks

ClimaTwin Global

Climate Disclosure Alignment

55+ countries, representing 60% of global GDP,

strengthening markets through the International Sustainability Standards Board (ISSB)

alignment and other climate-related financial disclosures

| Jurisdiction / Framework | Key Disclosure Requirements | Physical Risk Assessment | Financial Impact Modeling | Scenario Analysis | Governance & Strategy Reporting |

|---|---|---|---|---|---|

| California SB-261 | Climate-related financial risk & resilience strategies | ||||

| Other U.S. States (NY, MA, WA, and others) | State rules for climate financial risk; TCFD-aligned | ||||

| Canada – CSDS 1 & 2 | ISSB-aligned governance, strategy, risk, metrics | ||||

| UK – TCFD Mandate | Mandatory governance, strategy, risk, metrics reporting | ||||

| EU – CSRD (ESRS) | Double materiality; physical & transition risk; scenario & adaptation plans | ||||

| ISSB (IFRS S1 & S2) | Governance, strategy, risk, metrics; investor focus | ||||

| Australia & New Zealand | Mandatory/proposed TCFD-aligned climate disclosures | ||||

| Asia – Emerging Frameworks | Exchange/regulator ESG rules; TCFD/ISSB-aligned | ||||

| South America – Emerging Frameworks | Regulator/exchange ESG rules; TCFD/ISSB-aligned |

Frameworks FAQs

What is ClimaTwin’s Global Climate Disclosure Alignment?

It maps 55+ countries, covering 60% of global GDP, to ISSB, CSRD, TCFD, and other frameworks for easy compliance.

How does ClimaTwin support ISSB (IFRS S1 & S2)?

Our solution provides investor-focused governance, strategy, risk, and metrics reporting aligned with ISSB standards.

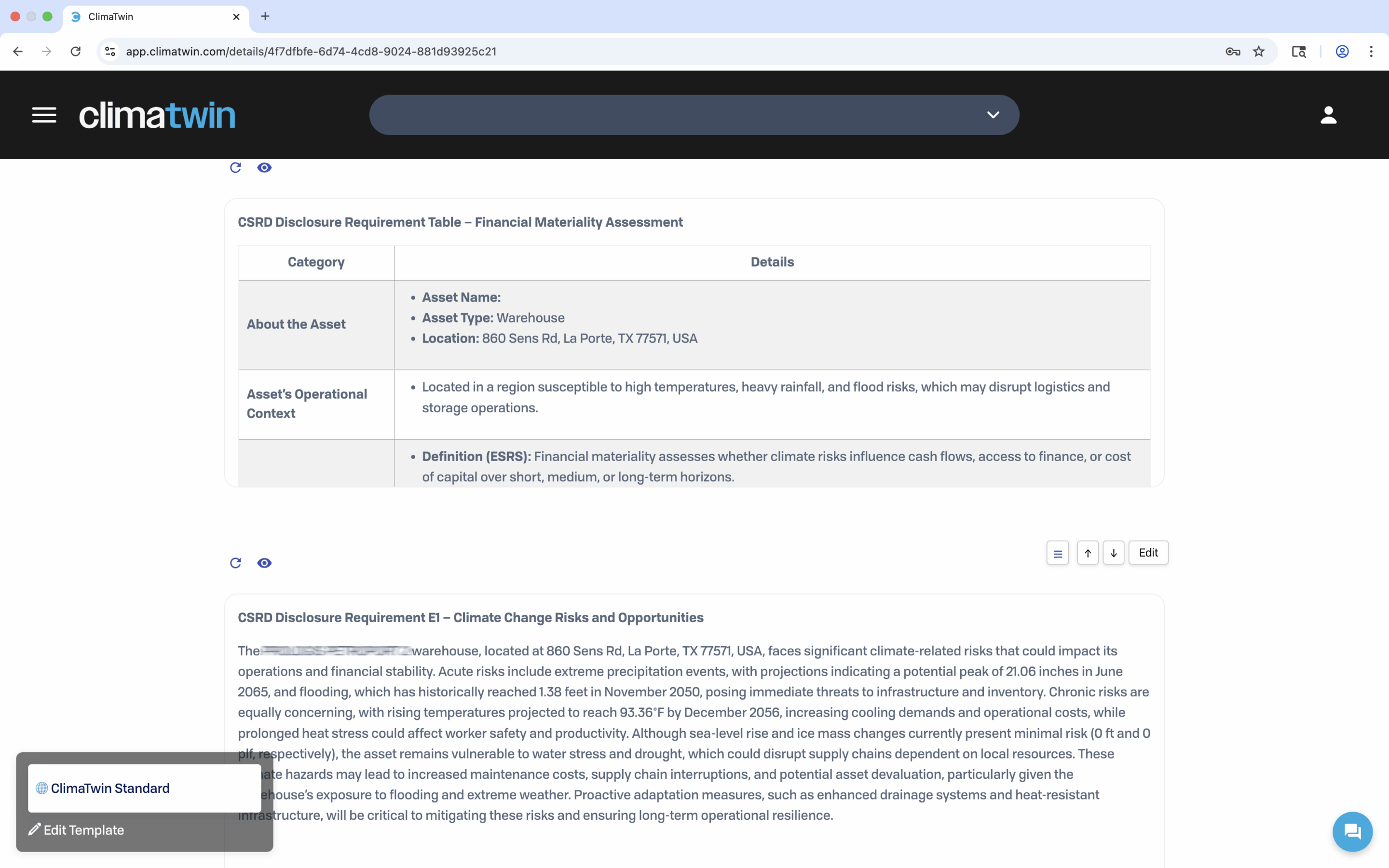

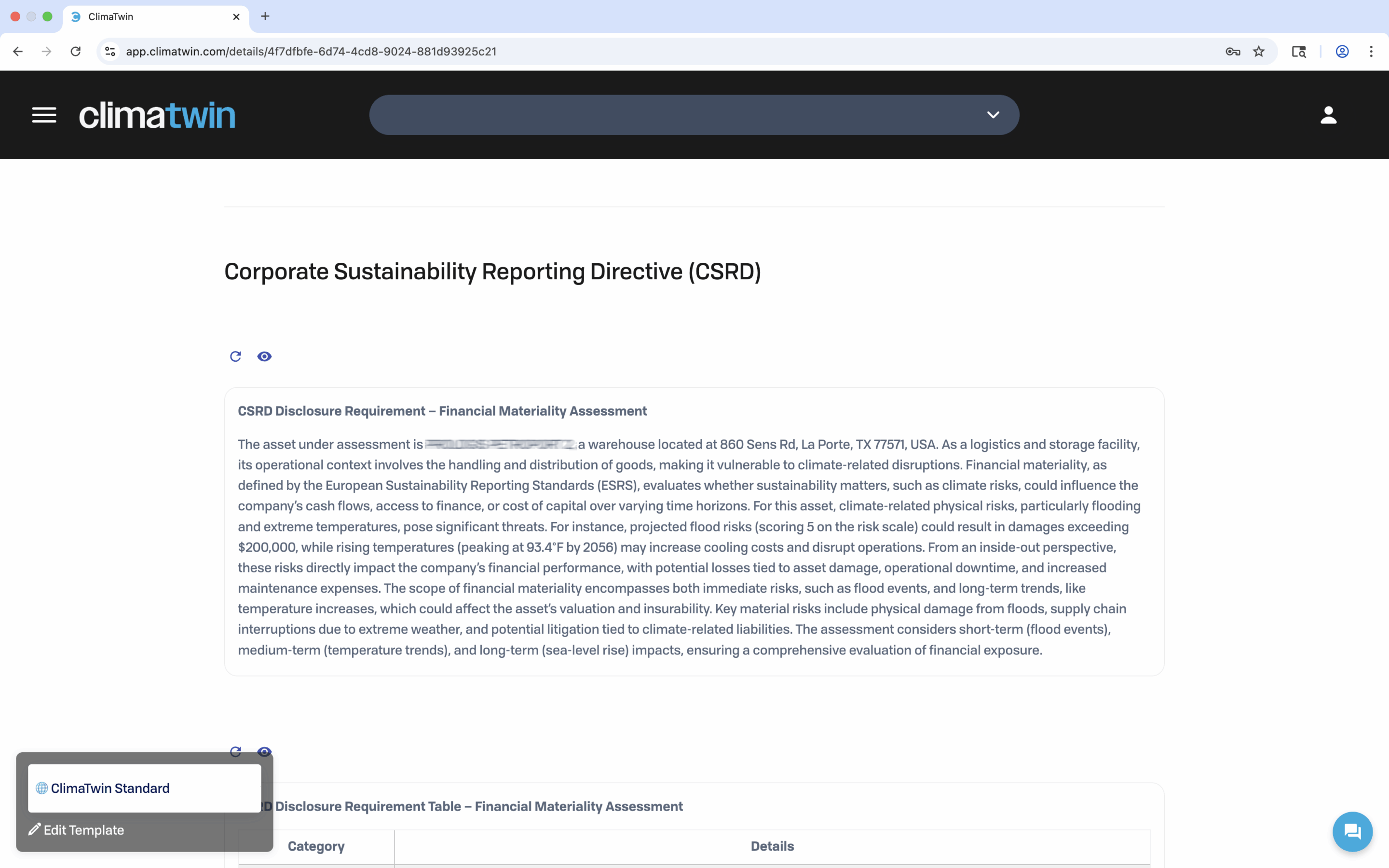

What are the EU’s CSRD (ESRS) requirements?

CSRD mandates double materiality, climate risk assessments, scenario analysis, and adaptation planning.

How does California’s SB-261 affect companies?

It requires disclosure of climate-related financial risks and resilience strategies; our solution automates compliance.

What are Canada’s CSDS 1 & 2 standards?

The standards are ISSB-aligned disclosure rules on governance, strategy, risk, and metrics for Canadian companies.

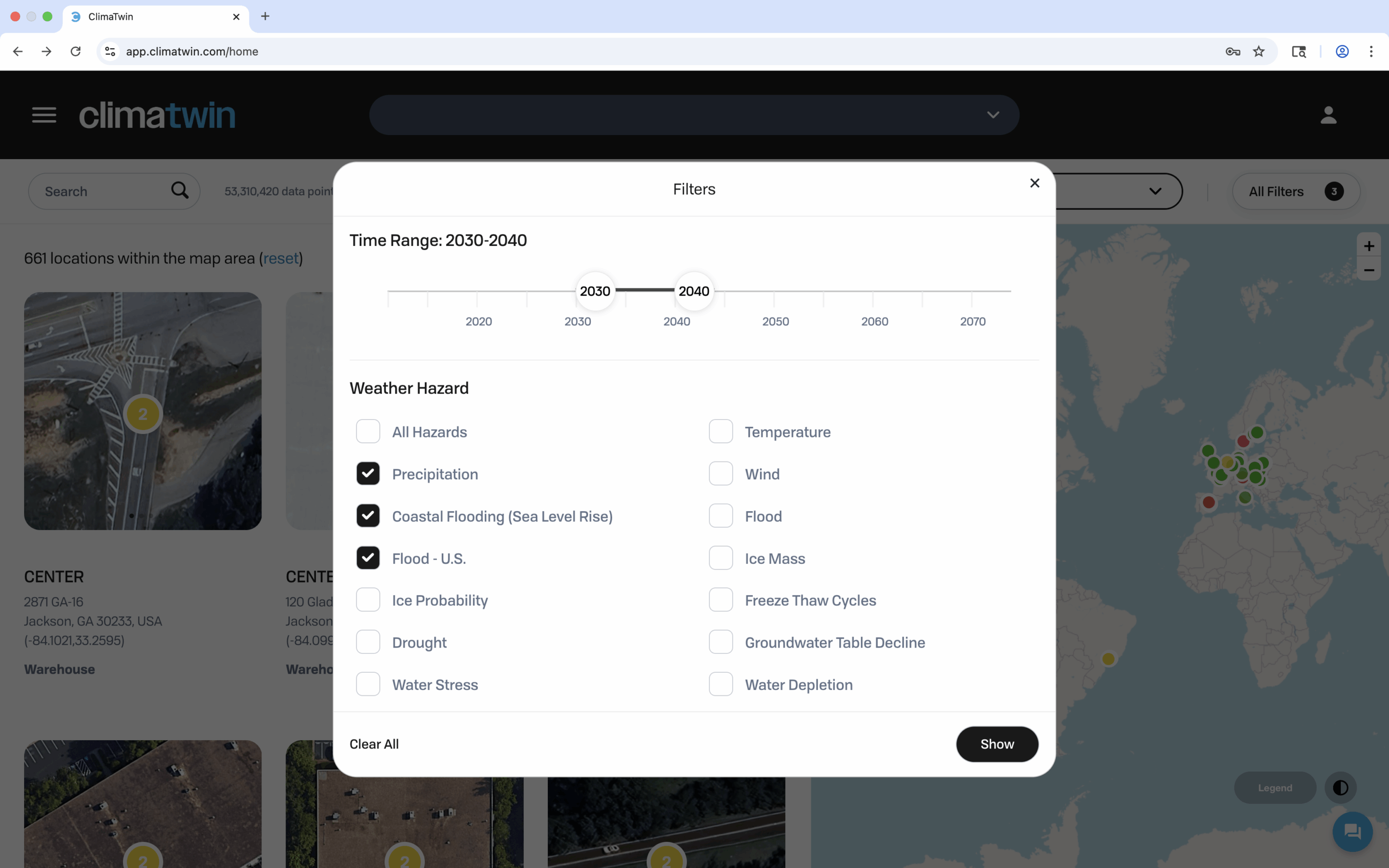

How does ClimaTwin perform physical risk assessments?

Our solution scores asset-level risks from floods, storms, wildfires, and heat, helping prioritize resilience investments.

What is climate-related financial impact modeling?

Our solution estimates financial losses from climate damage, disruptions, and delays to guide capital allocation.

Why is scenario analysis important?

Our solution stress-tests assets under moderate to extreme climate futures, ensuring adaptable strategies.

How does ClimaTwin support governance and strategy reporting?

Our solution provides ready-made reporting templates aligned with ISSB, CSRD, and TCFD requirements.

What are stakeholder-ready visualizations?

Our solution transforms risk data into clear visuals—charts, maps, and dashboards—for boards, investors, and regulators.

Ready To Get Started?

physical and financial impacts of future weather and climate extremes

on your infrastructure assets, capital programs, and investment portfolios.